Service Hotline

13751780907

13922748515

In the next two to three years, there will be a reshuffle in the robotics industry. The opportunity left for domestic robots is when the next Lewis turning point comes, and they need to be prepared to overtake others.

Human-robot collaboration is an inevitable choice, and China leads the global industrial robot market

Intelligent robots are the most complex and the robotic friends humanity most desires to create soon. Since the Czechoslovakian writer Karel Čapek introduced the concept of robots in his science fiction novels in the 1920s, scientists have never ceased their research on robots.

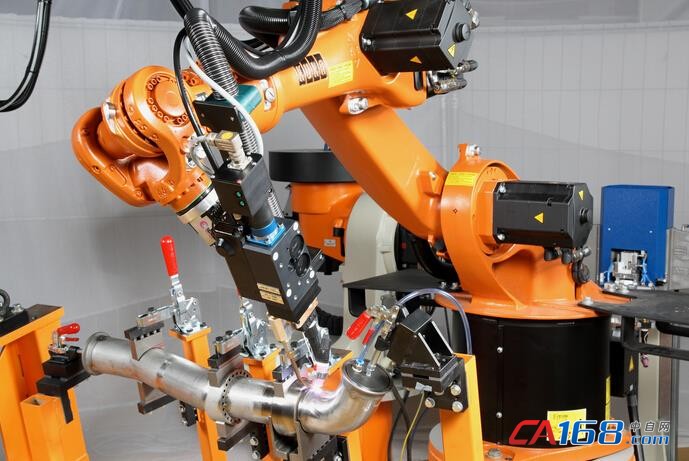

The robotics landscape has become vast. Based on their application areas, robots can be categorized into four major areas: industrial robots, service robots, specialized robots, and educational robots. Industrial robots can be further categorized by their purpose, including welding robots, handling robots, assembly robots, processing robots, and spraying robots. With the rapid development of intelligent equipment, the advantages and role of industrial robots in the global manufacturing industry are growing. Furthermore, industrial robots are at the forefront of both Industry 4.0 and the intelligent transformation of global enterprises.

Human-robot collaboration is a new form of industrial robotics development, combining human intelligence with the high efficiency of robots to jointly complete tasks. Simply put, humans directly operate robots with their hands. The industry has reached a consensus that human-robot collaboration is an inevitable choice for the evolution of robotics. Its characteristics are safety, ease of use, and low cost, allowing ordinary workers to operate them like electrical appliances.

In its latest research report, "Collaborative Robots Market and Current Developments," ABI Research predicts that the collaborative robots sector is expected to grow tenfold between 2015 and 2020, from nearly $95 million in 2015 to over $1 billion in 2020. Furthermore, ABI is not alone. Barclays Bank's capital goods analysts estimate that by 2025, the global collaborative robots market will reach $11.5 billion, up from $116 million last year. This will roughly equal the current size of the entire industrial robot market, making human-robot collaboration a necessity.

In fact, a report by the International Federation of Robotics predicts that the global industrial robot market will grow at an average annual rate of 6% from 2013 to 2016, with China leading this growth trend with an average annual growth rate of 15%. According to the "2016-2022 China Robotics Industry In-Depth Research and Development Prospects Forecast Report," China's industrial robot sales reached 56,000 units in 2014, marking two consecutive years of industry growth exceeding 50%. However, the penetration rate remains far lower than that of developed countries, indicating ample room for growth. According to IFR forecasts, my country's industrial robot sales will reach 100,000 units by 2017, representing an average annual growth rate of 23% from 2015 to 2017. After achieving global dominance, my country's industrial robot market is expected to maintain strong growth momentum.

Overall, the four major industrial robot manufacturers—ABB, KUKA, Yaskawa, and FANUC—currently hold approximately 80% of the Chinese industrial robot market share. All of them are foreign-funded. Industry experts predict a reshuffle in the robotics industry over the next two to three years. Starting in 2014, international giants launched a wave of price cuts, with companies like Kuka, Yaskawa, and ABB lowering the prices of their robot exports to China by approximately 20%. This external pressure has further accelerated industry consolidation and brought the reshuffle to a head. The opportunity for domestically produced robots lies in preparing to overtake competitors when the next Lewis turning point arrives.

However, within the industrial robot industry chain, the limited import of upstream core components has severely hampered the development of Chinese industrial robots. Most Chinese robotics companies are concentrated in the downstream system integration sector. The upstream, midstream, and downstream of the industrial robot industry chain are components, robotics bodies, and integration. Chinese companies are mostly concentrated in the integration sector, undertaking low-value-added tasks such as system secondary development, custom parts, and after-sales service. This is because the import of core components, especially RV reducers, has increased the cost of Chinese industrial robots, severely hindering the development of the industry.

Furthermore, industrial robot components urgently need breakthroughs in domestic production, and this requires large-scale mass production; otherwise, they will be meaningless. Only domestic robot companies that have the ability to develop robot parts, manufacture robot bodies and integrate systems have the foundation for large-scale industrialization and can gain an advantage in the subsequent competition.

Prev:China's 20-year internet dividend has peaked, ushering in a period of great harvest

Next:Matters needing attention in the maintenance of paint filling machines